7 Apps That Save You Money Automatically (No Effort Required)

Saving money can feel like a struggle—but it doesn’t have to. With the right apps, you can set it and forget it, letting technology help you build your savings effortlessly. These eight apps make it easy to grow your nest egg without thinking twice.

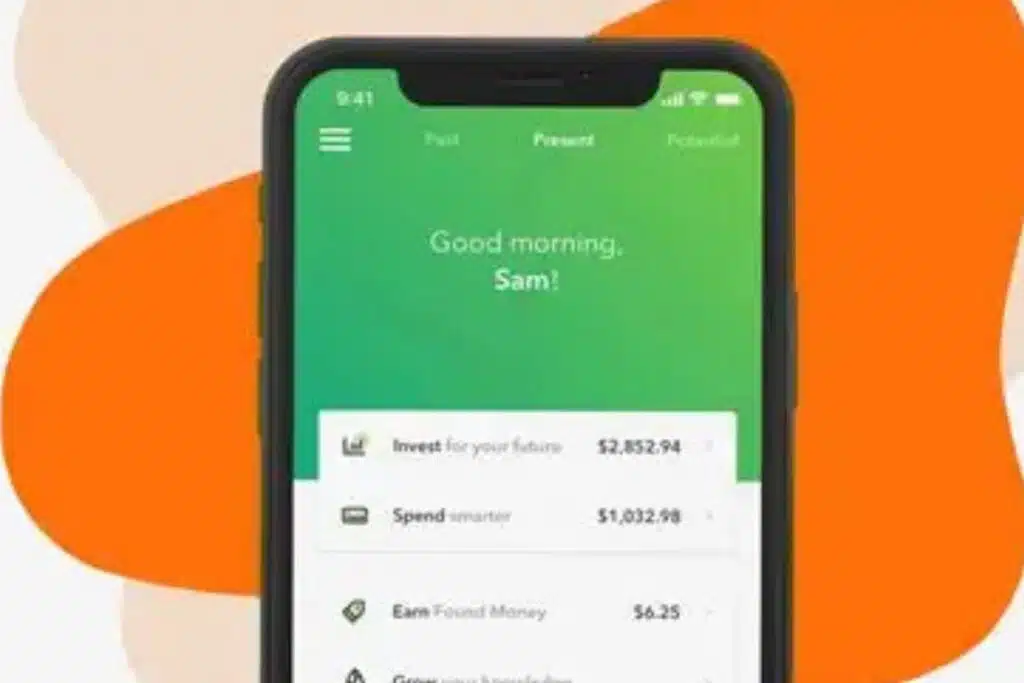

Acorns

Acorns rounds up your everyday purchases to the nearest dollar and invests the spare change. It’s a simple way to save without noticing the difference in your daily spending.

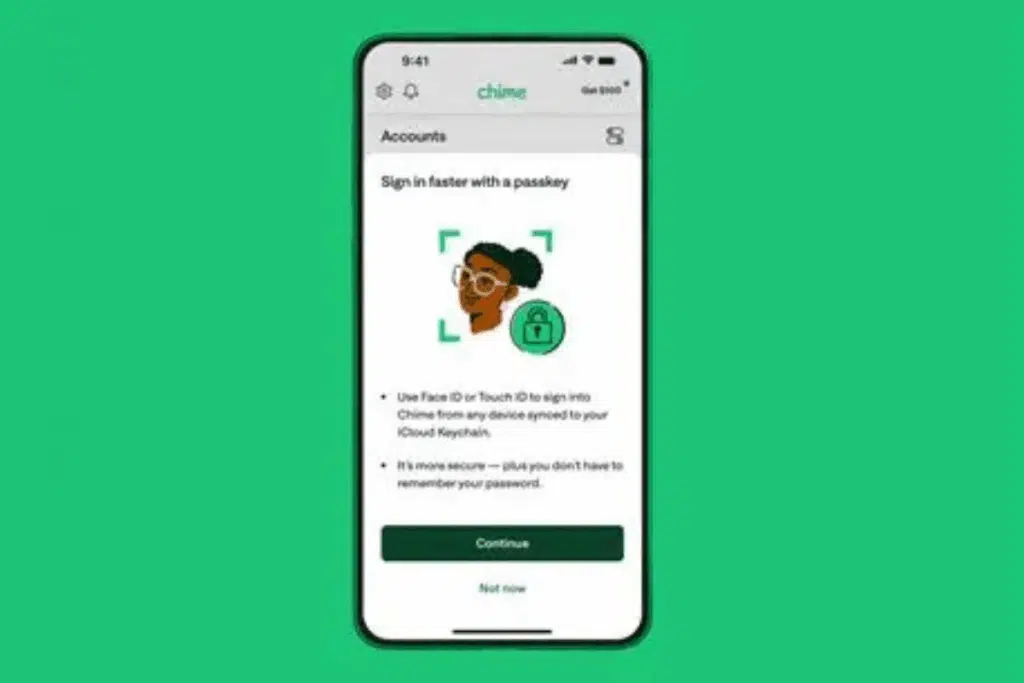

Chime

Chime’s automatic savings feature lets you round up transactions or automatically transfer a percentage of your paycheck into a separate savings account. It’s an easy, hands-off way to build an emergency fund.

Digit

Digit analyzes your spending habits and automatically transfers small amounts into a savings account. It’s perfect for those who want to save without worrying about the numbers.

Qapital

Set up “rules” with Qapital, like saving every time you buy coffee or hit a fitness goal. The app automates your savings so you reach your goals faster without thinking about it.

Twine

Twine is great for couples who want to save together. You can set shared goals and automate contributions, making it easier to reach milestones like vacations or a home down payment.

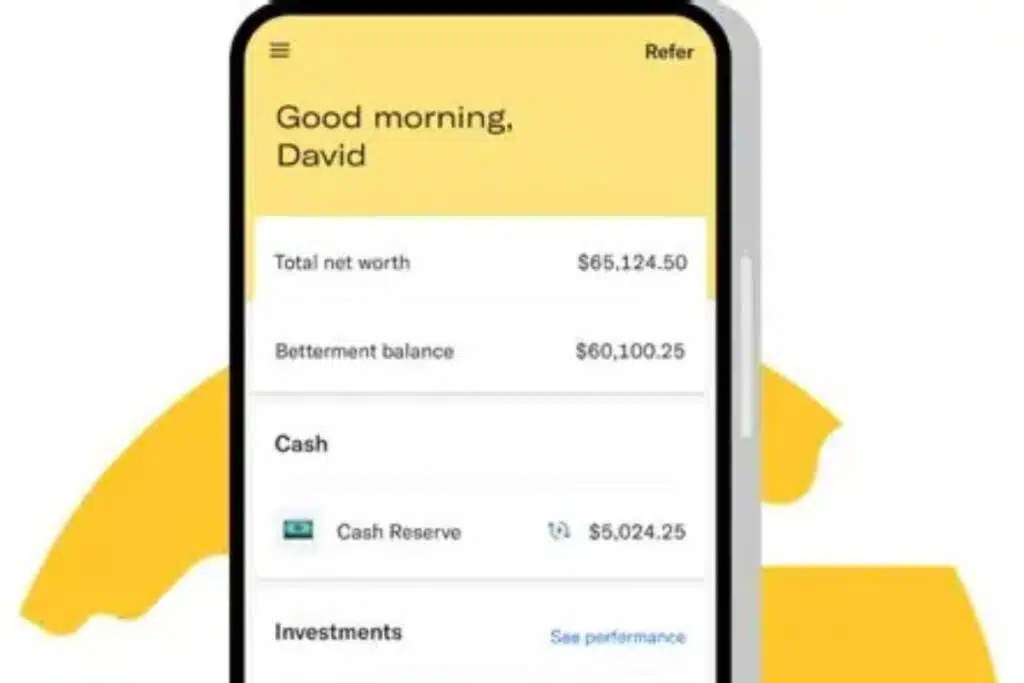

Betterment

Betterment is an investment-focused app that automatically saves and invests your money based on your goals. Over time, this can help your money grow faster than a traditional savings account.

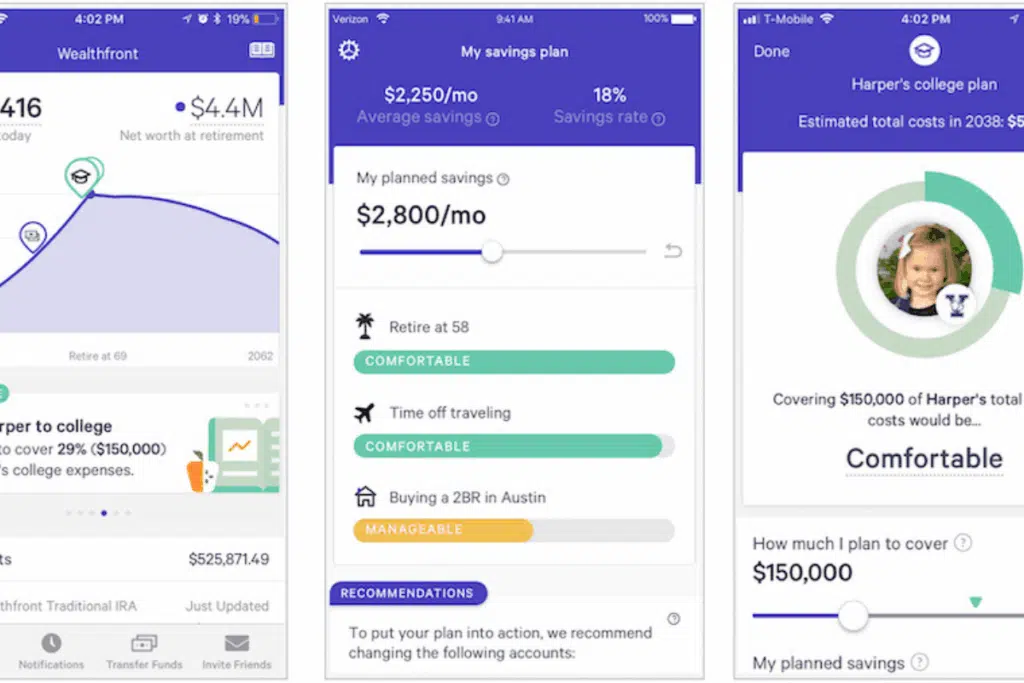

Wealthfront

Wealthfront’s automated savings and investing tools help you maximize your savings potential. The app can also analyze your finances to suggest ways to save more efficiently.

This post may contain affiliate links or sponsored content. Disclosure Policy