10 Modern Money Hacks That Actually Work

Managing money doesn’t have to be complicated—or boring. With a few smart tweaks, tech tools, and mindset shifts, you can stretch your income further, grow your savings faster, and stress less about finances. These modern money hacks are practical, proven, and perfect for today’s world.

Automate Your Savings

Set your bank to automatically transfer a small amount into savings every payday. You’ll build a financial cushion effortlessly—no willpower required—and be amazed at how quickly it adds up.

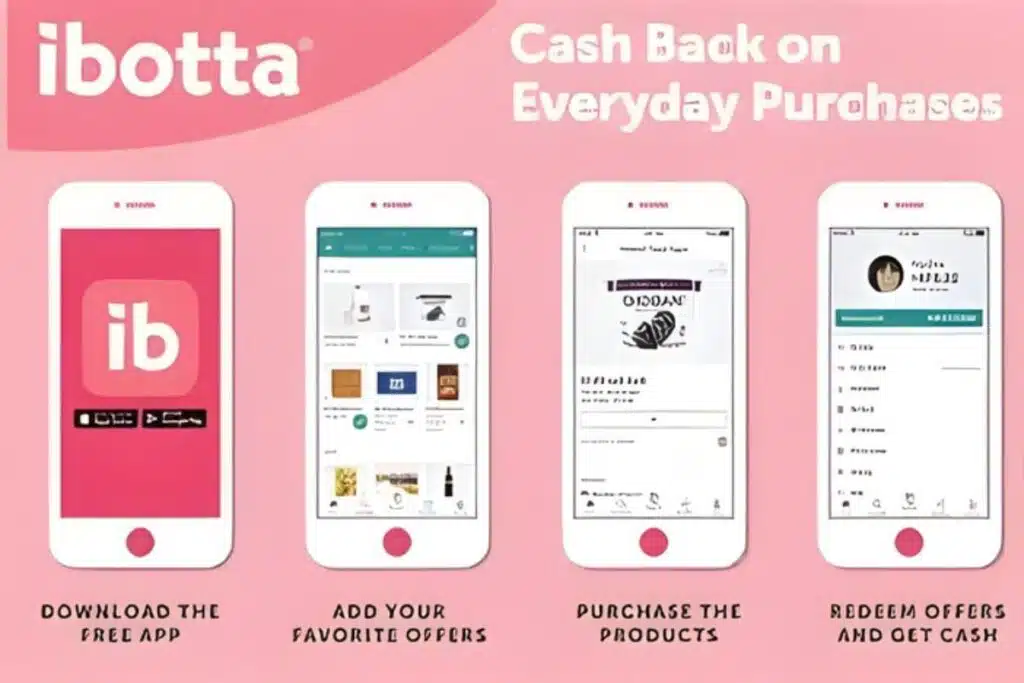

Use Cashback and Rewards Apps

From groceries to gas, cashback apps like Rakuten and Ibotta help you earn money on things you’re already buying. Stack them with credit card rewards for double the savings power.

Round Up Purchases to Save Spare Change

Apps like Acorns or Chime round up your purchases to the nearest dollar and invest the difference. It’s an easy, hands-off way to grow wealth using money you won’t even miss.

Negotiate Your Bills (Automatically)

Subscription and utility costs can quietly drain your budget. Try services like BillTrim or Rocket Money that automatically negotiate lower rates on your behalf—no awkward phone calls required.

Use the “24-Hour Rule” for Non-Essential Buys

Before clicking “checkout,” wait a day. This simple pause helps you curb impulse spending and ensures you only buy what you truly want or need.

Track Spending with Budgeting Apps

Apps like Mint and YNAB make budgeting less of a chore and more of a personal finance dashboard. Real-time insights help you spot waste, track goals, and stay accountable.

Automate Debt Payments

Automating your credit card or loan payments ensures you never miss a due date—and saves you from late fees that can derail progress. Plus, it helps improve your credit score over time.

Embrace “No-Spend” Challenges

Try a week—or even a month—of no unnecessary spending. You’ll reset your habits, rediscover creativity, and see just how much extra cash you can save.

Buy Gift Cards for Regular Expenses

Purchase discounted gift cards for stores you already shop at. It’s a simple way to lock in savings and stick to a preset budget without the temptation to overspend.

Start Micro-Investing

Even with just a few dollars, you can start investing through micro-investment apps. It’s a great way to dip your toes into the stock market and watch your money work for you—slowly but surely.

This post may contain affiliate links or sponsored content. Disclosure Policy